Contents:

Given that 1 https://g-markets.net/ in a EUR/USD pair is in the 4th decimal place (0.0001), this would mean that this EUR/USD quote has a 1-pip spread. It is 1/10 of a pip, usually calculated using the 5th decimal . In this guide we will explain how a pip works, how to calculate a pip and what’s the difference between a pip and a pipette. If you are interested in trading stocks, you may be wondering if there is such a thing like pip in stock trading.

ACY Securities Launches Pip Hunter Trading Contest for 2023 with $75,000 in Total Bonuses – ForexLive

ACY Securities Launches Pip Hunter Trading Contest for 2023 with $75,000 in Total Bonuses.

Posted: Wed, 01 Mar 2023 09:21:00 GMT [source]

For example, the currency pair could be EURUSD, EURJPY, USDCAD, or GBPAUD. Thus, Ramon made a profit of $8.96 due to a fluctuation in the EUR/USD currency pair. The Japanese yen is an exception because its exchange rate extends only two decimal places past the decimal point, not four. AxiTrader is 100% owned by AxiCorp Financial Services Pty Ltd, a company incorporated in Australia . Over-the-counter derivatives are complex instruments and come with a high risk of losing substantially more than your initial investment rapidly due to leverage.

What Are Pips in Forex Trading and What Is Their Value?

👉If the what is a pip in forex trading/USD moves 100 pips in a positive direction, you make a $100 profit. While the average investor probably shouldn’t dabble in the forex market, what happens there does affect all of us. The real-time activity in the spot market will impact the amount we pay for exports along with how much it costs to travel abroad. If the EUR/USD exchange rate is 1.2, that means €1 will buy $1.20 (or, put another way, it will cost $1.20 to buy €1). I used to work at a hedge fund and the largest bank in Hawaii. Now I help traders optimize their trading psychology and trading strategies.

We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey. The monetary value of PIP is primarily determined by leverage.

- For example, if a share price went from $25 to $30, traders would say it has moved 5 points.

- However, USD/JPY will also be affected by news about the yen itself, plus lots of other factors – so in live markets, things might not be so clear cut.

- Therefore, trading with an appropriate position size is essential.

- In most pairs involving the JPY, a pip equals a movement of 0.01 .

For example, the smallest whole unit move the USD/CAD currency pair can make is $0.0001 or one basis point. AxiTrader Limited is amember of The Financial Commission, an international organization engaged in theresolution of disputes within the financial services industry in the Forex market. A pip relates to movement in the fourth decimal place while a pipette is used to measure movement in the fifth decimal place. A pipette is a ‘fractional pip’ as it equals a tenth of a pip. If the market went the opposite way then the trader would of seen a loss. ‘Pip’ can stand for ‘percentage in point’ or ‘price interest point’ within the forex market.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Another case in point is the Turkish lira, which reached a level of 1.6 million per dollar in 2001, which many trading systems could not accommodate.

When trading, a trader will aim to make a profit by buying a currency pair at a lower price and selling it at a higher price. Simply, this is the standard unit for measuring how much the exchange rate has changed in value. Trading with price improvement protocols has been an increasingly used technique as the trading landscape continues to evolve. Utilizing PIPs comes with several advantages that make this form of trading increasingly popular. For example, when using a PIP, the trader can obtain significantly improved prices for upcoming orders because accuracy and speed are prioritized without sacrificing the quality of execution. Finally, by having access to multiple venues through a single execution technology, a trader can create systematic trade strategies and decrease their exposure to risk in the long run.

Trading

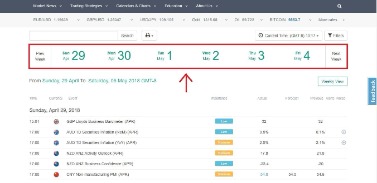

Day traders require technical analysis skills and knowledge of important technical indicators to maximize their profit gains. Just like scalp trades, day trades rely on incremental gains throughout the day for trading. Remember that the trading limit for each lot includes margin money used for leverage. This means that the broker can provide you with capital in a predetermined ratio.

Hankotrade Broker Review: A Must-Read Before Opening Your … – UrbanMatter

Hankotrade Broker Review: A Must-Read Before Opening Your ….

Posted: Mon, 06 Mar 2023 19:23:25 GMT [source]

These are made up of all the other combinations of major markets, such as EUR/JPY, AUD/NZD and EUR/GBP. Majors are the most actively traded currencies, constituting about 85% of the total FX volume. They typically cost less to trade than minor currency pairs, because they are bought and sold so much. Understanding pips in Forex is a prerequisite to learning more complicated concepts in trading. One of these is the volatility of Forex pairs, which is often expressed in the number of pips that a pair moves during a day. Cross pairs usually have larger pip movements than major pairs over the course of a day, which can be ascribed to relatively low liquidity.

Best legitimate forex traders to follow on Instagram

Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. The superscript number at the end of each price is the Fractional Pip, which is 1/10th of a pip. The fractional pip provides even more precise indication of price movements. The value of PIP varies depending on the particular currency pair chosen by the trader.

The forex market is more decentralized than traditional stock or bond markets. There is no centralized exchange that dominates currency trade operations, and the potential for manipulation—through insider information about a company or stock—is lower. High interest rates can make a currency more attractive to traders, increasing demand for the dollar and causing it to strengthen against the yen.

Fibonacci Retracements Strategy for Forex Traders

So, when trading 10,000 units of GBP/JPY, each pip change in value is worth approximately 0.813 GBP. As each currency has its own relative value, it’s necessary to calculate the value of a pip for that particular currency pair. Don’t even think about trading until you are comfortable with pip values and calculating profit and loss.

Most currency traders were largemultinational corporations,hedge funds, or high-net-worth individuals because forex trading required a lot of capital. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance. In this article, we gave a definition of pips in Forex trading and showed how it can be applied to calculate your total profit or loss on a trade, or your perfect position size.

EUR/USD short example

Therefore, traders tend to restrict such trades to the most liquid pairs and at the busiest times of trading during the day. However, not all forex quotes are displayed in this way, with the Japanese Yen being the notable exception. Keep reading to find out more about pips and how they’re used in forex trading, with examples from selected major currency pairs. Pips cannot be used in every context though, and in an environment of hyperinflation in currencies, exchange rates become difficult to calculate with pips. Hyperinflation refers to a period where prices of goods and services are increasing excessively and in an out-of-control fashion. When FX movements become extremely high, pips lose their utility.

Or if you’d like to try out trading on live markets,open a full account. This is because the yen is worth comparatively little to other major currencies. When you sell forex, you’re buying the quote currency by selling the base currency.

It’s a basic concept of forex trading and reflects the smallest price movement between the buy and ask price of two currencies. Traders and investors use the term pip to describe the bid-ask spread between the bid and ask prices of the currency pair and indicate how much money they have made or lost on a trade. One unique aspect of this international market is that there is no central marketplace for foreign exchange. This means that when the U.S. trading day ends, the forex market begins anew in Tokyo and Hong Kong. As such, the forex market can be extremely active anytime, with price quotes changing constantly. Forex traders look to profit from fluctuations in the exchange rates of currency pairs.